Let this sink in: annually, $3.1 trillion of U.S. GDP is lost because of poor quality data. It’s a staggering figure, one that Harvard Business Review attributes to the “hidden data factory”—the time that people across the enterprise waste dealing with flawed data.

Let this sink in: annually, $3.1 trillion of U.S. GDP is lost because of poor quality data. It’s a staggering figure, one that Harvard Business Review attributes to the “hidden data factory”—the time that people across the enterprise waste dealing with flawed data.

Bad data is bad for business. But hidden data—the data that your business users need but can never quite get their hands on—has its costs too.

Here are four examples that illustrate the cost of hidden data for you to consider:

1. Wasted Time

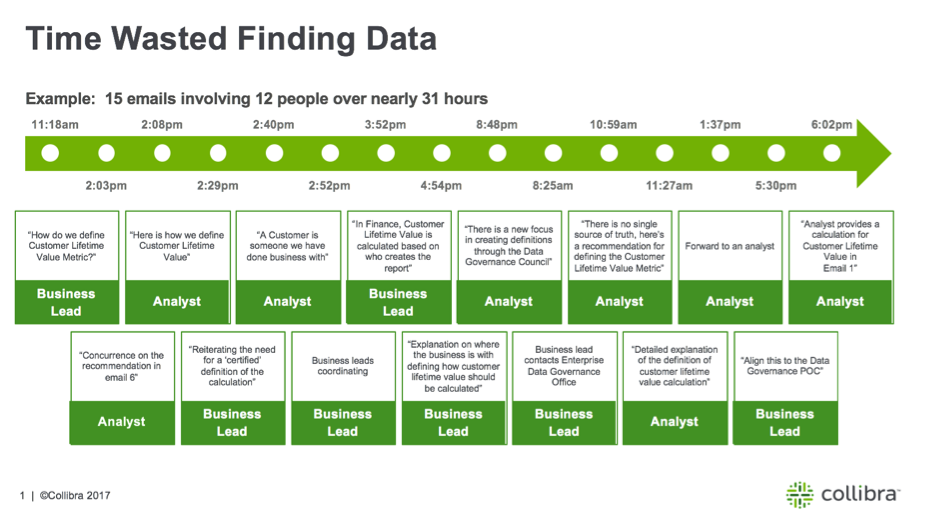

Harvard Business Review reports that decision makers, managers, data scientists, and knowledge workers are spending too much time looking for data. We agree. In fact, recently, we worked with one of our customers to document time spent defining a single data metric: lifetime customer value.

A search for Lifetime Customer Value involved 12 different business users (we’ve withheld their names to protect the innocent), generated 15 emails (which, honestly, isn’t the worst I’ve seen) and took 31 hours (almost 4 business days) to complete. Now, repeat this process just twice a month for a year and your organization will spend 93 working days in wasted effort—that’s 93 days that could have been spent solving real business problems.

A search for Lifetime Customer Value involved 12 different business users (we’ve withheld their names to protect the innocent), generated 15 emails (which, honestly, isn’t the worst I’ve seen) and took 31 hours (almost 4 business days) to complete. Now, repeat this process just twice a month for a year and your organization will spend 93 working days in wasted effort—that’s 93 days that could have been spent solving real business problems.

2. Failed Business Intelligence Initiatives

No doubt, we all recognize that the process documented in the illustration above isn’t a paragon of efficiency. It is, however, the best process these business users had at hand to solve their business needs. And those processes—efficient or not—become quickly embedded in organizational cultures.

If you can’t give your business users a better, faster way to find data (not just a less arbitrary one), they won’t bother using it. About $2 billion annually is wasted on failed BI projects. And most of those projects fail not because business users aren’t using data, but because they’re still working around your BI tools instead of with them.

3. Strategic Missteps

In addition to wasted time, struggling to define metrics like customer lifetime value has deeper implications. For one of our clients, it meant missing sales growth targets because they were focusing on the wrong customers. Their decision making was based on inaccurate metrics: growth targets were missed, the share price took a dip, and bonuses suffered. To achieve strategic goals, organizations need to make good decisions based on good information, metrics and reports. Hidden data will, at best, delay decision making (when critical data arrives late) and, at worst, sabotage decision making altogether (when critical data never arrives at all or when it does, is inaccurate), putting the business at risk.

4. Botched Priorities

Hidden data is often blamed on IT. They’re the people who know where all those data tables live and what they mean, right? Wrong. When business intelligence is driven by IT, all data remains equal. But data without context—without its associated business meaning—won’t be understood by the people who need it to do their jobs. When the data business users need is hidden in plain sight, when data can’t be shared because no one knows what it means, the “big picture” will always remain elusive, decision making will be impaired, and your ability to make the most of significant business opportunities will be lost. That is fundamentally a business problem. And it requires a business solution.

Now What?

The cost of hidden data is high. But there are remedies. For data to have value, it must be easy to find and trust—using sustainable processes and workflows. And it must be aligned to business needs and priorities. That requires a platform that will help you establish efficient, scalable data management processes—you wouldn’t, after all, try to manage accounting without a general ledger systems or sales without a CRM.