Climate change is no longer a distant threat, but a present reality that’s reshaping the insurance landscape across the United States. A recent New York Times investigation revealed that the impact of climate change on the U.S. home insurance market is far more severe and widespread than previously thought, potentially affecting every homeowner in the country.[1]

The Unexpected Spread of the Insurance Market Turmoil

Contrary to earlier assumptions, the crisis in the home insurance market is not limited to coastal areas or regions prone to hurricanes and wildfires. In 2023, the homeowner’s insurance market lost money in 18 states, a significant increase from just a few years ago.[1]

What’s particularly alarming is the spread of this crisis to unexpected places:

- Last year, insurance companies lost money on homeowner’s policies across the entire Midwest, from Pennsylvania to the Dakotas.[1]

- In Iowa, a state once considered a safe bet for insurers due to its relatively consistent weather, homeowners are now struggling to find coverage.[1]

This trend aligns with broader industry observations. A report by the Insurance Information Institute noted that insured losses from natural disasters in the US have risen significantly, from an average of $19 billion annually in the 1970s to $101.8 billion in 2021.[2]

The Rise of “Secondary Perils”

One key factor driving this widespread crisis is the increasing frequency and severity of what insurers call “secondary perils” — events like hailstorms, windstorms, and severe rainfall. These events, once considered minor annoyances for insurance companies, are now causing significant financial strain.[1]

In places like Marshalltown, Iowa, a combination of a tornado in 2018 and a derecho (a severe windstorm) in 2020 led to skyrocketing insurance costs and reduced coverage for homeowners.[1] Swiss Re corroborates this trend, reporting that secondary perils accounted for more than 70% of insured losses from natural catastrophes in 2020.[3]

The Ripple Effects

The implications of this crisis extend far beyond just higher insurance premiums:

- Home Values: Insurance becoming more expensive or unavailable could depress home values in affected areas. The First Street Foundation estimates that increasing flood risks alone could result in a $14.2 billion loss in property values over the next 30 years.[4]

- Mortgages: Banks are reluctant to issue mortgages for homes without adequate insurance coverage. A study by the Environmental Defense Fund suggests that climate-related risks could lead to a mortgage crisis similar to the 2008 financial crisis.[5]

- Local Economies: Falling home values could reduce tax revenue for local governments, affecting schools and public services.[1]

- Disaster Recovery: Homeowners may struggle to rebuild after disasters without adequate insurance, potentially leading to long-term economic impacts in affected communities.[6]

Data-Driven Approaches to Climate Risk Assessment

Considering these challenges, insurers and policymakers are turning to more sophisticated data-driven approaches for climate risk assessment:

- Granular Risk Modeling: Companies like Jupiter Intelligence for example are developing high-resolution climate models that can assess individual property-level risk.[7]

- Integration of Non-Traditional Data: Insurers incorporate data from sources like satellite imagery, IoT sensors, and social media to better understand price risk.[8]

- AI and Machine Learning: These technologies are being employed to process vast amounts of climate and property data, identifying patterns that human analysts might miss.[9]

The Controversial Take: A Hard Truth

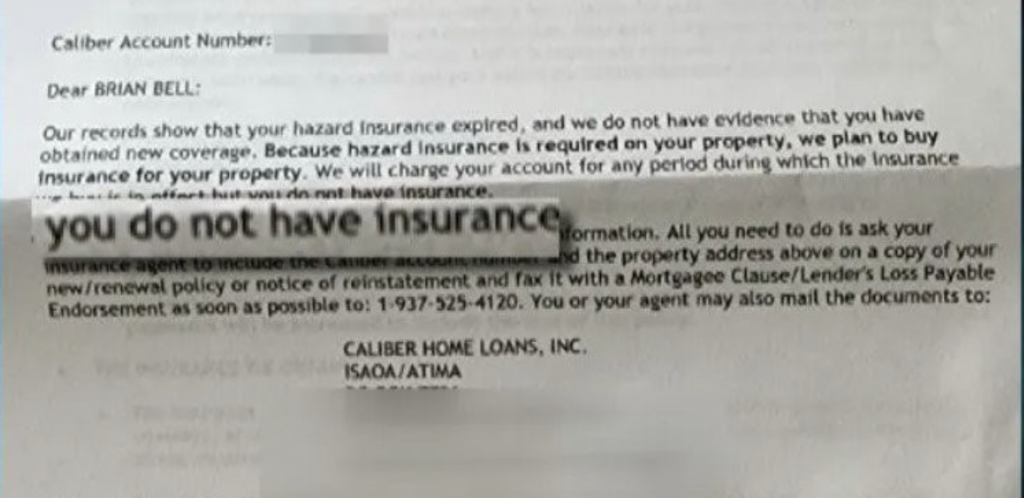

Here’s a hard truth: The threat of climate change might not manifest as we expected. Instead of communities being wrecked by dramatic storms or wildfires, the harbinger of doom could be as mundane as an insurance cancellation letter.[1] That’s one powerful image.

The future impact of climate change might be best understood not by analyzing weather data. but by examining the spreadsheets of insurance company profitability. As Christopher Flavelle, a climate reporter for The New York Times, puts it:

“Maybe the future of climate change is best seen not by poring over weather data from NOAA, but by poring over spreadsheets from rating firms, showing the profitability from insurance companies, and how, bit by bit, that money that they’re losing around the country tells its own story. And the story is these shocks are actually already here.”[1]

This perspective challenges our traditional view of climate change impacts and underscores the urgent need for a comprehensive approach to climate risk assessment and management.

Looking Ahead: The Future of Climate Risk Assessment in Insurance

As the insurance crisis deepens, several potential solutions are being explored:

- Risk Reduction Initiatives: Some states encourage homeowners to “harden” their homes against climate risks, offering insurance discounts as incentives.[10]

- Government Intervention: There’s growing discussion about the potential need for government-backed insurance programs similar to the National Flood Insurance Program.[11]

- Innovative Insurance Products: The industry is exploring new types of coverage, such as parametric insurance, which pays out based on the occurrence of a specific event rather than assessed damage.[12]

However, each solution has its own set of challenges and potential drawbacks. Navigating the complex interplay between climate science, risk management, public policy, and market forces will require careful navigation.

Conclusion: A Call to Action

The looming crisis in the U.S. home insurance system serves as a wake-up call for homeowners, insurers, policymakers, and climate scientists alike. It underscores the need for innovative, data-driven approaches to climate risk assessment and management.

As we navigate this complex landscape, one thing is clear: the future of home ownership and community resilience in the face of climate change will depend on our ability to assess and manage climate risks accurately. The insurance industry stands at the forefront of this challenge, and its success or failure will have far-reaching implications for American society.

What are your thoughts on this unfolding crisis? How do you think we should address the challenges of climate risk in the insurance industry? Share your insights and experiences in the comments below.

References

[1] Flavelle, C. (2024). The Possible Collapse of the U.S. Home Insurance System. The New York Times. https://www.nytimes.com/2024/05/15/podcasts/the-daily/climate-insurance.html

[2] Insurance Information Institute. (2022). Facts + Statistics: U.S. catastrophes. https://www.iii.org/fact-statistic/facts-statistics-us-catastrophes#:~:text=2022%20natural%20catastrophes,-Aon%20defines%20a&text=%2425%20million%20or%20more%20in,or%20homes%20and%20structures%20damaged.

[3] Swiss Re. (2021). Natural catastrophes in 2020: secondary perils in the spotlight, but don’t forget primary-peril risks. https://www.swissre.com/dam/jcr:ebd39a3b-dc55-4b34-9246-6dd8e5715c8b/sigma-1-2021-en.pdf

[4] First Street Foundation. (2021). The Cost of Climate: America’s Growing Flood Risk. https://assets.firststreet.org/uploads/2021/02/The_Cost_of_Climate_FSF20210219-1.pdf

[5] Environmental Defense Fund. (2019). Climate Risk and the Housing Market: A Preliminary Analysis.

[6] FEMA. (2020). Building Codes Save: A Nationwide Study. https://www.fema.gov/emergency-managers/risk-management/building-science/building-codes-save-study

[7] Jupiter Intelligence. (2023). Climate Risk Analytics for Resilience.

[8] McKinsey & Company. (2022). Insurance 2030: The impact of AI on the future of insurance. https://www.mckinsey.com/industries/financial-services/our-insights/insurance-2030-the-impact-of-ai-on-the-future-of-insurance

[9] Deloitte. (2021). AI and the Future of Underwriting. https://www2.deloitte.com/us/en/insights/industry/financial-services/future-of-insurance-underwriting.html

[10] National Association of Insurance Commissioners. (2023). Resilient America: State Resiliency Initiatives. https://content.naic.org/article/naic-adopts-first-national-climate-resilience-strategy-insurance-close-coverage-gaps-and-improve

[11] Congressional Research Service. (2022). The National Flood Insurance Program: Status and Issues for Congress. https://crsreports.congress.gov/product/pdf/IN/IN11049

[12] World Bank. (2021). Parametric Insurance: A Tool to Increase Climate Resilience. https://www.worldbank.org/en/results/2022/04/21/risk-insurance-builds-climate-and-disaster-resilience-in-central-america-and-the-caribbean