2020 was the kind of year that would make anyone in the predictions business more than a little gun shy. I certainly didn’t have “global pandemic” on my 2020 bingo card.

And, even if I somehow did, I would never have coupled that with a “booming stock market” and median SaaS price/revenue multiples in the 15x range.

That said, I’m back on the proverbial horse, so let’s dig in with a review of our 2020 predictions.

Remember my disclaimers, terms of use, and that this exercise is done in the spirit of fun and as a way to tee-up discussion of interesting trends, and nothing more.

2020 Predictions Review

Here a review of my 2020 predictions along with a self-graded, and for this year, pretty charitable, hit/miss score.

- Ongoing social unrest. No explanation necessary. HIT.

- A desire for re-unification. We’ll score that one a whopping, if optimistic, MISS. Hopefully it becomes real in 2021.

- Climate change becomes new moonshot. Swing and a MISS. I still believe that we will collectively rally behind slowing climate change. But feel like I was early on this prediction, particularly because we got distracted with, shall we say, more urgent priorities. (Chamath, a little help here please.)

- The strategic chief data officer (CDO) will increasingly morph into chief data & analytics officer (CDAO). CDO’s are indeed becoming more strategic. They are also increasingly worried about playing not only defense, but also offense with data. HIT.

- The ongoing rise of DevOps. In an era where we (vendors) increasingly run our own software, running it is increasingly as important as building it. Sometimes, more. HIT.

- Database proliferation slows. While the text of this prediction talks about consolidation in the DBMS market, happily, the prediction itself speaks of proliferation slowing. And that inconsistency gives me enough wiggle room to declare HIT. DB-Engines ranking shows approximately the same number of DBMSs today (335) as one year ago (334). While proliferation seems to be slowing, the list is most definitely not shrinking.

- A new, data-layer approach to data loss prevention. This prediction was inspired by meeting Cyral founder Manav Mital (I think first in 2018) after having a shared experience at Aster Data. I loved Manav’s vision for securing the set of cloud-based data services that we can collectively call the “data cloud.” In 2020, Cyral raised an $11M Series A, led by Redpoint and I announced that I was advising them in March. It’s going well. HIT.

- AI/ML success in focused applications. The keyword here was focus. There’s sometimes a tendency in tech to confuse technologies with categories. To me, AI/ML is very much the former; powerful stuff to build into now-smart applications that were formerly only automation. While data scientists may want an AI/ML workbench, there is no one enterprise AI/ML application – more a series of applications focused on specific problems, whether that be C3.AI in a public market context or Symphony.AI in private equity one. HIT.

- Series A remains hard. Well, “hard” is an interesting term. The point of the prediction was the Series A is the new chokepoint – i.e., founders can be misled by easily raising $1-2M in seed, or nowadays even pre-seed money, and then be in for a shock when it comes time to raise an A. My general almost-oxymoronic sense is that money is available in ever-growing, bigger-than-ever bundles, but such bundles are harder to come by. There’s some “it factor” whereby if you have “it” then you can (and should) raise tons of money at great valuations. Whereas, despite the flood of money out there, if you don’t have “it,” then tapping into that flood can be hard to impossible. Numbers wise, the average Series A was up 16% in size over 2019 at around $15M, but early-stage venture investment was down 11% over 2019. Since I’m being charitable today, HIT.

- Autonomy CEO extradited. I mentioned this because proposed extraditions of tech billionaires are, well, rare and because I’ve kept an eye on Autonomy and Mike Lynch, ever since I competed with them back in the day at MarkLogic. Turns out Lynch did not get extradited in 2020, so MISS. But the good news (from a predictions viewpoint) is that his extradition hearing is currently slated for next month, so it’s at least possible that it happens in 2021. Here’s Lynch’s website (now seemingly somewhat out of date) to hear his side of this story.

So, with that charitable scoring, I’m 7 and 3 on the year. We do this for fun anyway, not the score.

Kellblog’s Ten Prediction for 2021

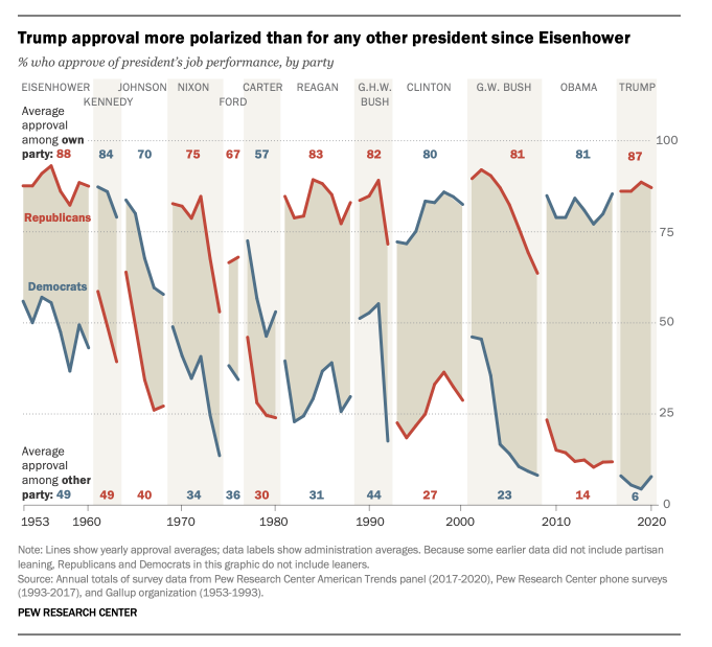

1. US divisiveness decreases, but unity remains elusive. Leadership matters. With a President now focused on unifying America, divisiveness will decrease. Unity will be difficult as some will argue that “moving on” will best promote healing, while others argue that healing is not possible without first holding those to account accountable. If nothing else, the past four years have provided a clear demonstration of the power of propaganda, the perils of journalistic bothsidesism, and the power of “big tech” platforms that, if unchecked, can effectively be used for long-tail aggregation towards propagandist and conspiratorial ends. The big tech argument leads to one of two paths:

(1) They are private companies that can do what they want with their terms of service and face market consequences for such, or

(2) They are monopolies (and/or, more tenuously, the Internet is a public resource) that must be regulated along the lines of the FCC Fairness Doctrine of 1949,but with a modern twist. It speaks not only to the content itself, but to the algorithms for amplifying and propagating it.

2. COVID-19 goes to brushfire mode. After raging like an uncontained wildfire in 2020, COVID should move to brushfire mode in 2021, slowing down in the spring and perhaps reaching pre-COVID “normal” in the fall, according to these predictions in UCSF Magazine. New variants are a wildcard and scientists are still trying to determine the extent to which existing vaccines slow or stop the B117 and 501.V2 variants. According to this McKinsey report, the “transition towards normalcy is likely during the second quarter in the US.” Though, depending on a number of factors, it’s possible that, “there may be a smaller fall wave of disease in third to fourth quarter 2021.” In my estimation, the wildfire gets contained in 2021, with brushfires popping up with decreasing frequency throughout the year. (Bear in mind, I went to the same school of armchair epidemiology as Dougall Merton, famous for his quote about spelling epidemiologist: “there are three i’s in there and I swear they’re moving all the time.”)

3. The new normal isn’t. Do you think we’ll ever go into the office sick again? Heck, do you think we’ll ever go into the office again, period? Will there even be an office? (Did they renew that lease?) Will shaking hands be an ongoing ritual? Or, in France, la bise? How about those red eyes to close that big deal? Will there still be 12-legged sales calls? Live conferences? Company kickoffs? Live three-day quarterly business reviews (QBRs)? Business dinners? And, by the way, do you think everyone – finally – understands the importance of digital transformation? I won’t do detailed predictions on each of these questions, and I have as much Zoom fatigue as the next person, but I think it’s important to realize the question is not “when we are we going back to the pre-COVID way of doing things?” It is instead, “what is the new way of doing things that we should move towards?” COVID has challenged our assumptions and taught us a lot about how we do business. Those lessons will not be forgotten simply because they can be.

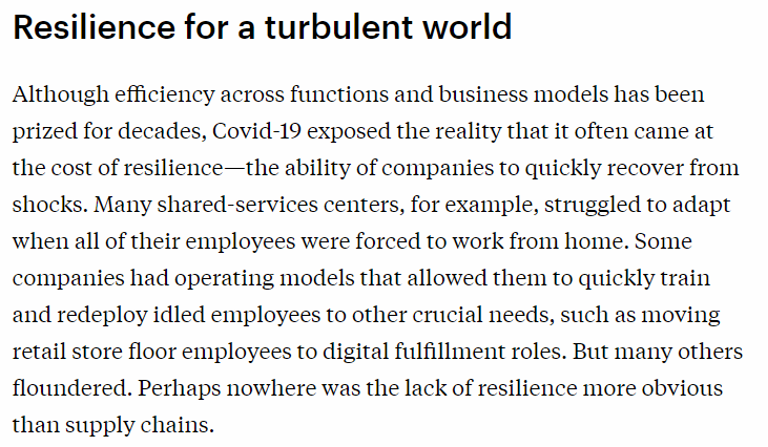

4. We start to value resilience, not just efficiency. For the past several decades we have worshipped efficiency in operations: just-in-time manufacturing, inventory reduction, real-time value chains, and heavy automation. That efficiency often came at a cost in terms of resilience and flexibility and, as this Bain report discusses, nowhere was that felt more than in supply chain. From hand sanitizer to furniture to freezers to barbells – let alone toilet paper and N95 masks — we saw a huge number of businesses that couldn’t deal with demand spikes, forcing stock-outs for consumers, gray markets on eBay, and countless opportunities lost. It’s as if we forget the lessons of the beer game developed by MIT. The lesson: efficiency can have a cost in terms of resilience and agility and I believe, in an increasingly uncertain world, that businesses will seek both.

5. Work from home (WFH) sticks. Of the many changes COVID drove in the workplace, distributed organizations and WFH are the biggest. I was used to remote work for individual creative positions such as writer or software developer. And tools from Slack to Zoom were already helping us with collaboration. But some things were previously unimaginable to me, e.g., hiring someone who you’d never met in the flesh, running a purely digital user conference, or doing a QBR which I’d been trained (by the school of hard knocks) was a big, long, three-day meeting with a grueling agenda, with drinks and dinners thereafter. I’d note that we were collectively smart enough to avoid paving cow paths, instead reinventing such meetings with the same goals, but radically different agendas that reflected the new constraints. And we – or at least I in this case – learned that such reinvention was not only possible but, in many ways, produced a better, tighter meeting.

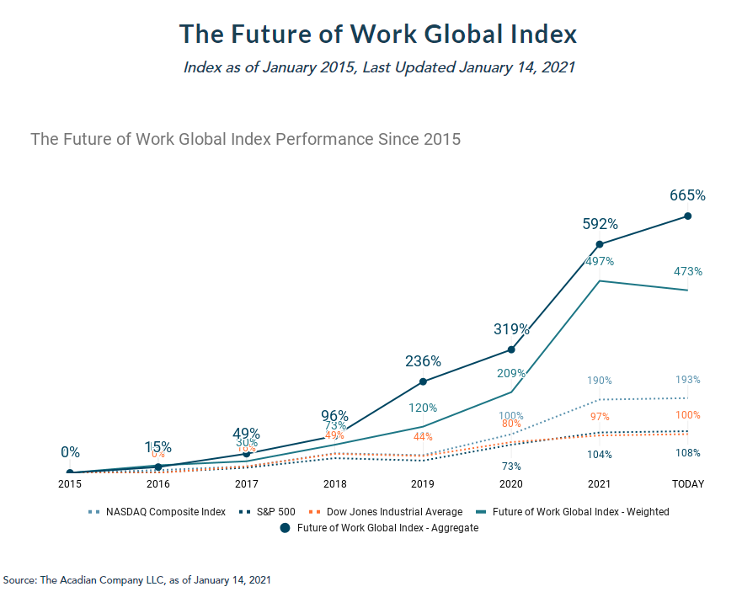

Such reinvention will be good for business in what’s now called The Future of Work software category such as my friends at boutique Future-of-Work-focused VCs like Acadian Ventures — who have even created a Bessemer-like Future of Work Global Index to track the performance of public companies in this space.

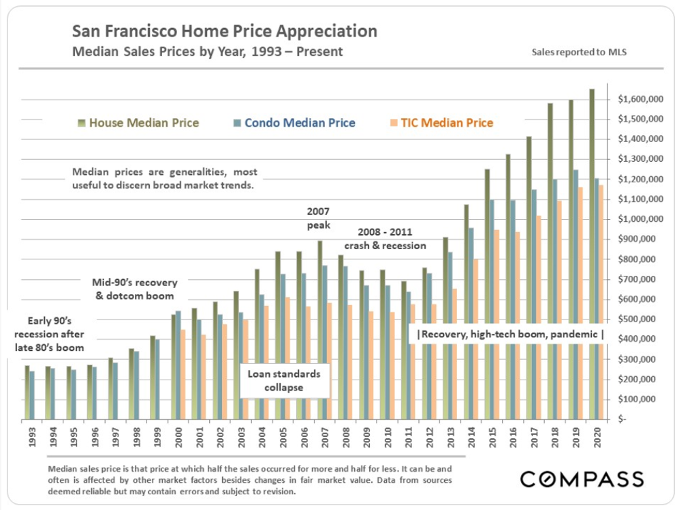

6. Tech flight happens, but with a positive effect. Much has been written about the flight from Silicon Valley because of the cost of living, California’s business-unfriendly policies, the mismanagement of San Francisco, and COVID. Many people now realize that if they can work from home, then why not do so from Park City, Atlanta, Raleigh, Madison, or Bend? Better yet, why not work from home in a place with no state income taxes at all — like Las Vegas, Austin, or Miami?

Remember, at the end of the OB (original bubble), B2C meant “back to Cleveland” – though, at the time, the implication was that your job didn’t go with you. This time it does.

The good news for those who leave:

- Home affordability, for those who want the classic American dream (which now has a median price of $2.5M in Palo Alto).

- Lower cost of living. I’ve had dinners in Myrtle Beach that cost less than breakfasts at the Rosewood.

- Burgeoning tech scenes, so you don’t have go cold turkey from full immersion in the Bay Area. You can “step down,” into a burgeoning scene in a place like Miami, where Founder’s Fund partner Keith Rabois, joined by mayor Francis Suarez, is leading a crusade to turn Miami into the next hot tech hub.

But there also good news for those who stay: house prices should flatten, commutes should improve, things will get a little bit less crazy — and you’ll get to keep the diversity of great employment options that leavers may find lacking.

Having grown up in the New York City suburbs, been educated on Michael Porter, and worked both inside and outside of the industry hub in Silicon Valley, I feel like the answer here is kind of obvious. Yes, there will be flight from the high-cost hub, but the brain of system will remain in the hub. So, it went with New York and financial services, it will go with Silicon Valley and tech. Yes, it will disperse. Yes, certainly, lower cost and/or more staff-y functions will be moved out (to the benefit of both employers and employees). Yes, secondary hubs will emerge, particularly around great universities. But most of the VCs, the capital, the entrepreneurs, the executive staff, will still orbit around Silicon Valley for a long time.

7. Tech bubble relents. As an investor, I try to never bet against bubbles via shorts or puts because “being right long term” is too often a synonym for “being dead short term.” Seeing manias isn’t hard, but timing them is nearly impossible. Sometimes change is structural – e.g., you can easily convince me that if perpetual-license-based software companies were worth 3-5x revenues that SaaS companies, due to their recurring nature, should be worth twice that. The nature of the business changed, so why shouldn’t the multiple change with it?

Sometimes, it’s actually true that This Time is Different. However, a lot of the time it’s not. In this market, I smell tulips. But I started smelling them over six months ago, and BVP Emerging Cloud Index is up over 30% in the meantime. See my prior point about the difficultly of timing.

But I also believe in reversion to the mean. See this chart by Jamin Ball, author of Clouded Judgement, that shows the median SaaS enterprise value (EV) to revenue ratio for the past six years. The median has more than tripled, from around 5x to around 18x. (And when I grew up 18x looked more like a price/earnings ratio than a price/revenue ratio.)

What accounts for this multiple expansion? In my opinion, these are several of the factors:

- Some are structural: recurring businesses are worth more than non-recurring businesses so that should expand software multiples, as discussed above.

- Some are the quality of companies: in the past few years, some truly exceptional businesses have gone public (e.g., Zoom). If you argue that those high-quality businesses deserve higher multiples, having more of them in the basket will pull up the median. (And the IPO bar is as high as it’s ever been.)

- Some are future expectations, and the argument that the market for these companies is far bigger than we used to think. SaaS and product-led growth (PLG) are not only better operating models, but they actually increase TAM in the category.

- Some is a hot market: multiples expand in frothy markets and/or bubbles.

My issue: if you assume structure, quality, and expectations should rationally cause SaaS multiples to double (to 10), we are still trading at 80% above that level. Ergo, there is 44% downside to an adjusted median-reversion of 10. Who knows what’s going to happen and with what timing but, to quote Newton, what goes up (usually) must come down. I’m not being bear-ish; just mean reversion-ish.

(Remember, this is spitballing. I am not a financial advisor and don’t give financial advice. See disclaimers and terms of use.)

8. Net dollar retention (NDR) becomes the top SaaS metric, driving companies towards consumption-based pricing and expansion-oriented contracts. While “it’s the annuity, stupid” has always been the core valuation driver for SaaS businesses, in recent years, we’ve realized that there’s only one thing better than a stream of equal payments – a stream of increasing payments. Hence NDR has been replacing churn and CAC as the headline SaaS metric on the logic of, “who cares how much it cost (CAC) and who cares how much leaks out (churn) if the overall bucket level is increasing 20% anyway?” While that’s not bad shorthand for an investor, good operators should still watch CAC and gross churn carefully to understand the dynamics of the underlying business.

This is driving two changes in SaaS business, the first more obvious than the second:

- Consumption-based pricing. As was passed down to me by the software elders, “always hook pricing to something that goes up.” In the days of Moore’s Law, that was MIPS. In the early days of SaaS, that was users (e.g., at Salesforce, number of salespeople). Today, that’s consumption pricing a la Twilio or Snowflake. The only catch in a pure consumption-based model is that consumption better go up, but smart salespeople can build in floors to protect against usage downturns.

- Built-in expansion. SaaS companies who have historically executed with annual, fixed-fee contracts are increasingly building expansion into the initial contract. After all, if NDR is becoming a headline metric and what gets measured gets managed, then it shouldn’t be surprising that companies are increasingly signing multi-year contracts of size 100 in year 1, 120 in year 2, and 140 in year 3. (They need to be careful that usage rights are expanding accordingly, otherwise the auditors will flatten it back out to 120/year.) Measuring this is a new challenge. While it should get captured in remaining performance obligation (RPO), so do a lot of other things, so I’d personally break it out. One company I work with calls it “pre-sold expansion,” which is tracked in aggregate and broken out as a line item in the annual budget.

See my SaaStr 2020 talk, Churn is Dead, Long Live Net Dollar Retention, for more information on NDR and a primer on other SaaS metrics. Video here.

9. Data intelligence happens. I spent a lot of time with Alation in 2020, interim gigging as CMO for a few quarters. During that time, I not only had a lot of fun and worked with great customers and teammates, I also learned a lot about the evolving market space.

I’d been historically wary of all things metadata; my joke back in the day was that “metadata presented the opportunity to make meta-money.” In the old days just getting the data was the problem — you didn’t have 10 sources to choose from. Who cared where it came from or what happened to it along the way, and what rules (and there weren’t many back then) applied to it. Those days are no more.

I also confess I’ve always found the space confusing. Think:

Wait, does “MDM” stand for master data management or metadata management, and how does that relate to data lineage and data integration? Is master data management domain-specific or infrastructure, is it real-time or post hoc? What is data privacy again? Data quality? Data profiling? Data stewardship? Data preparation, and didn’t ETL already do that? And when did ETL become ELT? What’s data ops? And if that’s not all confusing enough, why do I hear like 5 different definitions of data governance and how does that relate to compliance and privacy?”

To quote Edward R. Murrow, “anyone who isn’t confused really doesn’t understand the situation.”

After angel investing in data catalog pioneer Alation in 2013, joining their board in 2016, and joining the board of master data management leader Profisee in 2019, I was determined to finally understand the space. In so doing, I’ve come to the conclusion that the vision of what IDC calls data intelligence is going happen.

Conceptually, you can think of DI as the necessary underpinning for both business intelligence (BI) and artificial intelligence (AI). In fact, AI increases the need for DI. Why? Because BI is human-operated. An analyst using a reporting or visualization tool who sees bad or anomalous data is likely going to notice. An algorithm won’t. As we used to say with BI, “garbage in, garbage out.” That’s true with AI as well, even more so. Worse yet, AI also suffers from “bias in, bias out” but that’s a different conversation.

I think data intelligence will increasingly coalesce around platforms to bring some needed order to the space. I think data catalogs, while originally designed for search and discovery, serve as excellent user-first platforms for bringing together a wide variety of data intelligence use cases including data search and discovery, data literacy, and data governance. I look forward to watching Alation pursue, with a hat tip to Marshall McLuhan, their strategy of “the catalog is the platform.”

Independent of that transformation, I look forward to seeing Profisee continue to drive their multi-domain master data management strategy that ultimately results in cleaner upstream data in the first place for both operational and analytical systems.

It should be a great year for data.

10. Rebirth of Planning and Enterprise Performance Management (EPM). EPM 1.0 was Hyperion, Arbor, and TM1. EPM 2.0 was Adaptive Insights, Anaplan, and Planful (nee Host Analytics). EPM 3.0 is being born today. If you’ve not been tracking this, here a list of next-generation planning startups that I know (and for transparency my relationship with them, if any.)

- Budgyt

- Cube (angel investor)

- Decipad (friend)

- Jirav

- LivePlan

- Mosaic

- OnPlan (friend)

- Pigment

- PlaceCPM

- Plannuh (marketing planning, advisor)

- Runway

- Stratify

- TruePlan

- Vareto

Planning is literally being reborn before our eyes, in most cases using modern infrastructure, product-led growth strategies, stronger end-user focus and design-orientation, and often with a functional, vertical, or departmental twist. 2021 will be a great year for this space as these companies grow and put down roots.