Data professionals often talk about the importance of managing data and information as organizational assets, but what does this mean?[i] What is the actual business value of data and information? How can this value be measured? How do we manage data and information as assets? These are some of the questions that I intend to address in this series of articles.

The first question we need to ask is: What exactly is an “asset”? According to the Financial Accounting Standards Board,[ii] an asset has three essential characteristics:

– It can be managed for the benefit of an enterprise, either singularly or in combination with other assets.

– A particular enterprise can obtain the benefit of the asset, and control access to it by other enterprises.

– The transaction or event giving rise to the enterprise’s right to control the asset has already occurred; that is, the investment has already been made and the asset is available for use.

The CPA Journal puts it like this: “Data is an economic asset that can help organizations improve operations, increase revenue, solidify relationships with stakeholders, produce new revenue streams, improve the quality of current products, establish competitive differentiation, allow innovation, and reduce risks.”[iii]

Therefore, an asset can be defined as a resource that can be managed in such a way as to create some sort of value (or benefit) for an enterprise. The generated value, in turn, can be managed in ways that give an organization some kind of competitive advantage. Both the asset and the generated value of the asset must be manageable, and the economic benefit of the asset must be measurable.

Data vs. Information Assets

In this series of articles, I’m going to talk about managing both data and information as assets because what’s required for this management is similar for both data and information. However, they are not the same thing. Data becomes information when it is packaged in a form (a communication) that enables the receiver of the communication to solve a problem, answer a question, or take advantage of an opportunity. When people talk about data as an asset, they often say that data is “the new oil” or “the new water.” However, both oil and water need to be treated or refined into a form that enables them to meet specific needs (e.g., treating water to make it drinkable, or refining raw petroleum into gasoline or heating oil). One author put it this way:

When computers were first introduced into the business world, they were used to process data. They were workhorses … Then it became apparent that these workhorses could report summarized data to management to inform management of what was going on. Computer reports began servicing the users’ operational and information needs … Too often, they ask, What data do you want as opposed to What information do you need?[iv]

It’s important to understand that data (in its raw and unprocessed form) is not necessarily an asset to a business. Only when that data is properly “refined” and is available to meet the information needs of organizations can it be considered an asset. As the CPA Journal puts it:

CPAs today face a similar challenge. Organizations gather data without thinking through the implications of doing so. Actual storage costs continue to decrease, encouraging organizations to hoard data to the greatest extent possible because they believe that it has some future economic benefit, even though the accounting profession continues to struggle with assigning a financial value to an item with intangible properties.[v]

It is the conversion of data into information — data converted to a format that facilitates a decision maker’s ability to make a more effective decision — that drives data’s ultimate asset value and facilitates its ability to generate new business opportunities or reduce fraud, waste, and abuse.

What Is the Business Value of Data?

What is the business value of data and information (or, to put it another way, why can data and information be regarded as business assets)? For one, data is used to bring business stakeholders together around a common set of facts and information that can be shared across an organization and used for decision-making. To use another metaphor, it provides a community with a common pool of water from which everyone can drink. If we all have access to a common and agreed-upon set of facts, then we can see the current state of our organization and have intelligent, reasoned discussions about what we should and shouldn’t do. These conversations become impossible when everybody is living in self-selected “information bubbles” based on cherry-picked data, data selection bias, cognitive bias, and narrative fallacies. Everybody needs to be on the same page about what is and isn’t happening. This “common pool of water” is a critical enabler of many important business functions, including cross-divisional reporting, regulatory compliance, data analytics, and real-time decision-making.

Another value of data is that it can be used to create value-generating information streams (Virtual Value Streams) that connect organizations to their stakeholders in creative and profitable ways.[vi] David R. Vincent has made the point that in the new global economy, business value is created by establishing and nurturing relationships with business stakeholders.[vii] He makes the further point that the essence of effective relationships lies in empowerment, in giving people the ability to do more things for themselves and to create value at the lowest possible level of organizations.

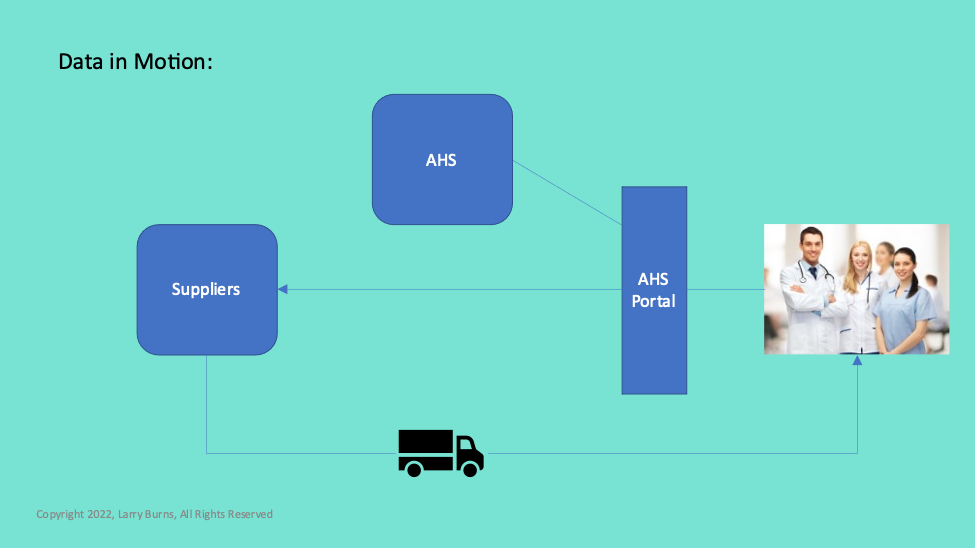

For example, Cabela’s, the sporting goods store, automatically emails discount offers to preferred customers on goods that are being closed out of inventory. American Hospital Supply (AHS) created an online subscription portal that customers can use to order directly from AHS’s suppliers. Customers pay AHS a monthly subscription fee for use of the portal and get discount prices and faster service. AHS’s suppliers get more customers and more orders. AHS gets a percentage of each order and saves on not having to maintain a warehouse of inventory and a fleet of delivery trucks. They also get happier customers!

Data and information can also be used to help organizations improve and streamline their business processes. For example, Six Sigma is a data-driven process improvement methodology used by many large corporations. Ford Motor Company used such a methodology to streamline their order procurement process, replacing a manual process involving three different paper documents and three groups of people with a single database containing the order that can be verified and updated at the receiving dock.[viii] This streamlining cut weeks from the process of invoicing orders and paying vendors! Ford also automated its design-to-manufacture process, enabling it to take bigger design risks and produce car designs that have greater customer appeal.

Data and information can be used to flatten (and therefore streamline) corporate hierarchies and reduce intermediaries, thus giving more responsibility to empowered individuals and entrepreneurial teams. Businesses can lower costs by, for example, automating material handling and delivering parts “just in time” to workers on the assembly line. They can use data and information to add intelligence to their products. For example, streaming data broadcast from long-haul trucks can signal dispatchers when a part failure in the truck is detected. The dispatcher can then direct the truck driver to the nearest service center. Companies can also use data and information to enhance their brand differentiation. American Express, for example, has developed differentiated travel services for its corporate customers, using information systems to search for the lowest airline fares, hotels and rental cars, and tracking travel expenses for each cardholder.

Data and information also act as essential disruptors. Hammer and Champy note that customers have gained the upper hand in their relationships with sellers, in part because customers now have easy access to enormously more data.[ix] The popularity of online ordering through Amazon, for example, can be explained by the ease with which consumers can compare products and prices side-by-side to get the best deal. American Airlines used its SABRE reservations system to develop a preferred (and highly profitable) relationship with travel agents. Now, consumers can use sites like Travelocity and Expedia to book their own reservations and bypass travel agents entirely!

The example of American Hospital Supply (AHS), referenced above, is a good example of how an organization can make use of data and information as essential disruptors to completely reimagine and reengineer its business processes. AHS used to have a standard business model of buying products from suppliers, storing them in warehouses, and then delivering them to customers. Now, through its online portal, customers can order products directly from suppliers, saving time, trouble, and expense for everyone involved! This business transformation puts AHS in a better position to compete with other online retailers such as Amazon.

Data is used to fuel the business analytics that enable companies to more effectively manage their customers and identify cross-selling and up-selling opportunities, identify new markets, create and evaluate new products and services, identify under-performing products and markets, and respond to changing market conditions in real or near-real time.

Finally, most organizations have data that can be packaged and monetized (i.e., sold to others). Customer and order data is often sold to third-party marketers and used for targeted advertising of related goods and services. Polk Automotive (now part of S&P Global) sells packaged data pertaining to national vehicle registration that most car and truck manufacturers use.

As we will see in the next installment of this series, the common denominator is that data creates business value when it is in motion, not at rest. The key to getting business value from data is to share it, not hoard it!

Image used under license from Shutterstock

[i] I realize that I may be over-simplifying things a bit for the purpose of this thought exercise. For one thing, most people think of data as a resource rather than an asset. However, as I intend to make clear, what makes a resource an asset is the way it is managed, and that nothing can be considered an asset that isn’t effectively managed. Therefore, it is permissible to talk about managing data as an asset, because the management itself is what turns data from a resource to an asset. Also, when I talk about managing both data and information as assets, I’m not implying that they are the same thing. Data becomes Information when it is put into a form (a communication) that enables the receiver of the communication to solve a problem, answer a question, or take advantage of an opportunity. But both data and information can be considered assets when they are managed in a way that promotes their reusability across an organization.

[ii] Financial Accounting Standards Board. Statement of Financial Accounting Concepts No. 3: Elements of Financial Statements of Business Enterprises (Stamford, Conn., December 1980).

[iii] Collins, Virginia. “Managing Data As An Asset”. The CPA Journal, June 2019.

[iv] Piron, Stephen F. “Management Information Systems: Data vs. Information: The Difference,” Management Accounting, March 1981.

[v] The CPA Journal, op. cit.

[vi] See Rayport, Jeffrey F. and John J. Sviokla: Exploiting the Virtual Value Chain. Harvard Business Review, November-December 1995, pp. 75-85.

[vii] Vincent, David R. The Information-Based Corporation: Stakeholder Economics and the Technology Investment (Dow Jones-Irwin, 1990).

[viii] Hammer, Michael and James Champy. Reengineering the Corporation: A Manifesto for Business Revolution (HarperCollins Publications, 1993), pp. 40-44.

[ix] Reengineering the Corporation, op. cit., p. 20.